A few months ago I was asked to be on a podcast to discuss how the wine industry could interest more young people in wine. Due to circumstances, that podcast’s topic changed to discussing how to counter the Neo-prohibitionist campaigns that use marginal results from health studies to frighten people away from drinking altogether. That is for another post.

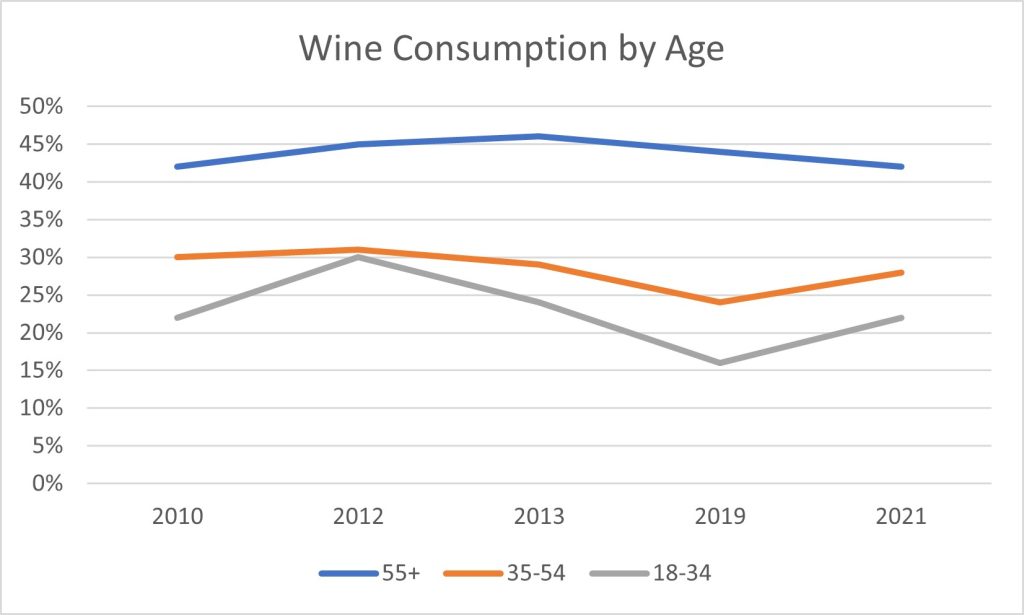

As to marketing wine to the Next Generation, alarm bells are being wrung for an apparent decline in the US in the consumption of wine. Much of this concern is in response to the sense that young people aren’t getting interested in wine, and so the wine drinking demographic is aging. In 2021, 42% of wine drinkers are age 55 or older versus 28% age 35 to 54 and 22% age 18 (?) to 34 – leading to a consensus among analysts that wine drinkers are aging and younger generations are not choosing wine. (Source: Gallup: https://news.gallup.com/poll/353858/alcohol-consumption-low-end-recent-readings.aspx)

Let’s examine that conclusion. Here is comparable data from Gallup on wine consumption by age from past years (Source: Gallup; gaps are due to no age-related information published online that year):

Let’s examine that conclusion. Here is comparable data from Gallup on wine consumption by age from past years (Source: Gallup; gaps are due to no age-related information published online that year):

| 55+ | 35-54 | 18-34 | |

| 2010 | 42% | 30% | 22% |

| 2012 | 45% | 31% | 30% |

| 2013 | 46% | 29% | 24% |

| 2019 | 44% | 24% | 16% |

| 2021 | 42% | 28% | 22% |

| Mean | 44% | 28% | 23% |

It is important to note that the youngest demographic segment in the Gallup statistics includes three years of age below the legal limit for drinking, which would naturally lower that segment’s percentages. Still, that’s pretty consistent, yes? The age spread in 2010 is nearly identical to that of 2021. Really, what that data shows are two conclusions:

- The wine industry has always been terrible at marketing to younger generations.

- People migrate to drinking wine as they get older.

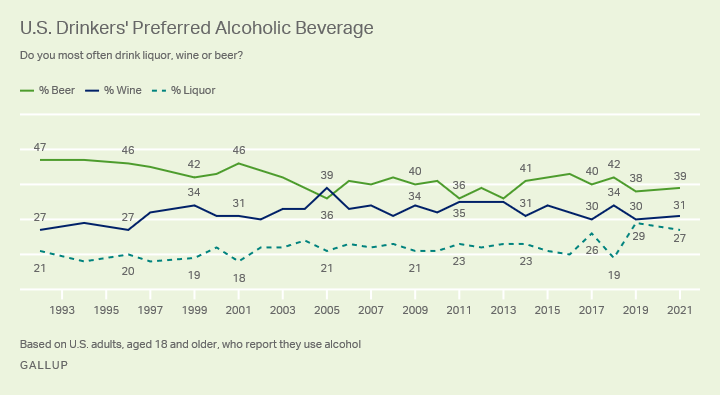

Drinking has lost some popularity. Preferences among beverages fluctuate. Partly this is because there is more choice in the types of adult beverages today, and partly because younger people favor beverages that they understand or know. However, US wine sales did pretty well in 2021. Sales were up 16.8% and volume up 3.8% over 2020, which did see a pandemic-caused decrease. (That was very much contrary to the headlines last year proclaiming people drank like fish during the pandemic.) Preference for wine – albeit buffeted by trends such as craft beer and cocktails – has remained fairly steady in the 21st Century:

The future does hold challenges for the wine industry. The aging of the Baby Boomer generation will soon cause a decline in sales and volume; it is a massive demographic followed by a much smaller one. It is inevitable that as Boomers age and stop drinking wine, the Gen X’ers – given their less numbers – will not pick up the full difference. Per capita consumption is plateauing in the US. Many industry trends are to blame. Excessive pricing (without legitimacy, see below), raises the risk of purchase for many to unacceptably high. The affordable category of wine is shrinking due to several factors: costs are going up, small production has higher costs than mass production, and higher prices = higher profit margins plain and simple, i.e., “greed is good” is the main philosophy for shareholder-owned wineries. Rather than expanding the consumer base the big wine corporations just buy their competitors to expand their own sales. The main wine media is fixated on ridiculous numerical scores and reviews, which have no impact on general consumers. Wine wholesale distributors barely take orders any more much less actively market the wines in their portfolios, and insist on increasing margins and higher payouts to sell any wine. The retail landscape changed away from specialty stores to big box chains where buying advice is limited to 3″ x 4″ cards taped on shelves. Restaurants continue to flat-out gouge customers on wine, whether off the list or serving it by-the-glass.

The future does hold challenges for the wine industry. The aging of the Baby Boomer generation will soon cause a decline in sales and volume; it is a massive demographic followed by a much smaller one. It is inevitable that as Boomers age and stop drinking wine, the Gen X’ers – given their less numbers – will not pick up the full difference. Per capita consumption is plateauing in the US. Many industry trends are to blame. Excessive pricing (without legitimacy, see below), raises the risk of purchase for many to unacceptably high. The affordable category of wine is shrinking due to several factors: costs are going up, small production has higher costs than mass production, and higher prices = higher profit margins plain and simple, i.e., “greed is good” is the main philosophy for shareholder-owned wineries. Rather than expanding the consumer base the big wine corporations just buy their competitors to expand their own sales. The main wine media is fixated on ridiculous numerical scores and reviews, which have no impact on general consumers. Wine wholesale distributors barely take orders any more much less actively market the wines in their portfolios, and insist on increasing margins and higher payouts to sell any wine. The retail landscape changed away from specialty stores to big box chains where buying advice is limited to 3″ x 4″ cards taped on shelves. Restaurants continue to flat-out gouge customers on wine, whether off the list or serving it by-the-glass.

Technology’s impact on our society continues to be the biggest challenge and opportunity in marketing today. The reach of the internet into our lives continues to grow – smartphones, social networks, chat and text, podcasts, video, etc. – and will continue to do so. The internet is integral to our functioning today. The nature of communications have become highly networked and instantaneous yet diverse and fractured; this is changing how people absorb and use information. We the audience must sort and sift through multiple channels, media, and types of information. More than ever brevity, legitimacy, and creativity are vital to capture attention and interest.

It is important for any winery and industry to grow their audience, and the younger generations will be aging into those periods in life when they will have disposable income available to pursue interests and pleasures. Millennials are equal to if not greater than the Baby Boomer generation in numbers. Reaching out to them now to spark their interest in wine is a wise move.

What the Industry Can Do

Past industry-wide campaigns have not been effective. They might have moved the needle a little for short periods, but as the graphs and numbers above show, they haven’t made a long-term impact. The primary industry marketing organization, the Wine Market Council, is an industry research agency that does nothing with the research they do. They leave it up to their members to do something with their data.

A new group may try their hand at crafting an industry marketing strategy, WineRAMP. At the moment it is still in the organizational phase. For this writer, hope is low for the new org as the founding members are all industry analysts (including the president of the Wine Market Council), white, middle aged, and 75% male. Old, male, pale, and stale industry leaders have been driving wine marketing since the 70’s.

The industry needs to come together, do the behind-the-scenes grunt work, and forget the ineffective, expensive, high-profile, marketing campaigns. Marketing wine is hampered by societal and regulatory constraints, many of which are unnecessary leftovers from Prohibition (yes, nearly 90 years later). The industry should tackle instead:

- Oppose further consolidation among the top 50 largest wine conglomerates and top 10 largest wine wholesale distributors.

- Fight for uniform interstate sales and shipping regulations for wineries and wine retailers selling direct to consumers and trade.

- Petition the federal government to move alcohol packaging and marketing regulation from the Department of the Treasury Alcohol and Tobacco Tax and Trade Bureau (TTB) to the Federal Food and Drug Administration (FDA) for meaningful regulations on labels, packaging, health warnings, and ingredient labeling.

- Take the lead on drafting useful ingredient and calorie labeling regulations.

- Counter the distorted and inflammatory Neo-prohibitionist campaigns that frighten and confuse people about the risks of consuming alcohol.

- Work with social interest groups and develop effective industry guidelines to promote safe, moderate consumption.

- Promote minority-owned businesses and industry persons.

- Promote small and mid-size wineries in the bottom 45 states (e.g., states other than CA, WA, OR, NY, and TX).

- Establish eco-friendly practices in farming, production, packaging, sales, and marketing.

None of those issues are very sexy and they don’t inspire massive fundraising from the big players in the industry (some are counterproductive to the big players’ interests). But accomplishing those goals would open market access for smaller wineries to reach more customers, provide consumers with useful information on health and safety, get in step with mitigating climate change, and promote much desperately needed diversity and inclusion in our industry. Those are issues cited by the Next Generation as VERY important to them: health, climate change, diversity, and supporting local products.

What we don’t need is another “Wine. Since 6000 B.C.” campaign.

What Wineries Can Do

Wine has an inherent dichotomy: it is a fundamentally complex product that demands simplicity in marketing. Every aspect of the production of wine can create differences in the end product. Those permutations take years of learning to grasp. 99% of consumers have no interest in doing so. Yet most consumers do appreciate that wine is an agricultural product that is crafted by highly trained viticulturists and winemakers into a digestible art form, a liquid that can transform over years into even more sublime versions of itself, and that no two wines are alike. That simple mystique is what brings most people to wine.

A great number of wineries (and media, wine retailers, sommeliers, etc.) get lost in selling a bizarre form of that mystique, believing that some alchemical stew of technical winemaking data mixed with poetic-to-outlandish tasting descriptors stirred with soil composition studies and weather reports and served with fantastical food pairings is what most consumers want. A tiny minority of wine drinkers do want that information. But it is not the main interest of the majority of consumers and certainly not new, young consumers. Wine marketing should not feel like you are reading an enologist’s doctorate dissertation while studying for a Masters of Wine qualification.

Be Interesting

It is a standing joke in wine marketing that the every winery starts their story with, “We are a small, family-owned winery founded on our passion for wine.” Most wine marketing books, blogs, and pundits tell their audiences that consumers crave “authenticity.” “Tell your story,” they advise, “Let your customers know what is unique about you.” The nasty little secret is that no matter how “authentic” you may be, the vast odds are that you are not unique in any way that is genuinely interesting. Very few wineries do anything out of the ordinary. Even E&J Gallo is “family owned.”

Creating interest is different than just creating something unique. Indeed, the best marketing is authentically interesting – marketing that creatively portrays the people and personalities behind the winery and why they do what they do. Don’t be dogmatic, traditionally authentic – be real and really interesting.

Be Creative

This is no small challenge. The need for brevity in today’s marketing demands creativity. As easy as it is, plastering your website with glossy photos of vineyards at sunset or your Instagram feed with posed snapshots of impossibly happy, young, fashionable people clutching glasses of wine is not creative. It is bathetic.

Okay, let’s get The Prisoner out of the way. This is the brand that succeeded beyond what the creators probably imagined. It did so because its packaging imagery was creative, different, and edgy. The brand created its own mystique that didn’t refer to any of that staid alchemical stew of place or pH. But we do not need more Prisoners. It succeeded because it is was the first of its type. Replicating it is not being creative.

All of us are drawn to creative content, young people especially. The deluge of content today is so overwhelming that our filters are set on high. It is the creative that gets noticed and implants itself into our consciousness. Wineries need to approach all operations and output creatively, from their packaging to their tasting room environment to the swag they give away at events. Creativity is most powerful when it is consistent across your brand.

Build Legitimacy

Whether your wine is $15 or $500 a bottle on the shelf, it will only sell if it provides a value to the customer. Wineries marketing their products need to justify their value to build legitimacy with their customers. As I wrote in another post, “Value is a trust proposition that wineries build over time by balancing price, quality, and satisfaction (brand equity). It is not a metric of how expensive a wine is.”

Younger generations do not have the disposable income to risk experimenting. One reason beer is consistently favored is that the risk of a purchase is low for those that like beer. It is a safe bet. So is a gin and tonic; it’s a known quantity so is easy to justify a price. Both come in smaller serving sizes, too, lowering the risk.

As previously written, wine is inherently complex. No two wines are the same (excluding the mass-produced wines on supermarket bottom shelves). A Chardonnay from a single winery will be different year to year. It will almost certainly come in a 750-mL bottle. The risk of purchase is much higher, even for some knowledgeable wine drinkers.

Bombarding consumers with grams of total acidity and descriptors of peaches and cream is not the solution. Providing a point of entry to your product is, such as smaller containers at reasonable prices. Or serving wine by-the-glass at prices truly competitive with beer and cocktails. Or using broad, recognizable, accurate tasting descriptors (dry vs. sweet, oak flavoring vs. none, tart vs. fruity, etc.). Providing relevant data can justify value: where (in general) the fruit is from, the grape(s) and other ingredients used, whether the wine is organic, how much was made, how many calories it contains, etc. But espousing how the vineyard is planted in sedimentary gravel-clay soils using tight vine-row spacing and the wine is aged in 100% Radoux barrels does not justify price to anyone but the CFO of the winery and those trying for a WSET Level 4 diploma.

Alternative Packaging

This wouldn’t be a post on this site if alternative wine packaging wasn’t mentioned. However, beyond our championing alternative packaging, climate change is making this a vital discussion, and that resonates VERY strongly with the Next Generation. The glass bottle with a natural cork bark stopper is 17th century packaging (though the first glass bottles were made in 1500 B.C. in Mesopotamia). It is superbly efficient at preserving wine for decades. But as packaging for most wines consumed within weeks or months from purchase it is highly wasteful and inefficient. It is fragile, heavy, and its shape wastes space.

Almost every form of alternative wine packaging is better for the environment. While glass can be recycled and reused, its weight, shape, and fragility remain issues to the process of recycling or reuse. Aluminum cans and bottles, bag-in-box, PET (especially post-consumer-recycled PET), and flexible pouches tackle those three drawbacks of glass, and most have equally recyclable materials.

The tyranny of the glass bottle made the 750-mL size the overwhelming standard as it is the most cost-effective size for the medium. Smaller bottles have higher glass-to-wine ratios so cost more per ounce, and larger bottles get heavy quickly. Alternative packaging opens the market to many more efficient container sizes, especially single-serving sizes. Smaller sizes mean smaller prices, too. The convenience of buying the volume you want versus what is standard – along with reducing fragility and weight, better portability, better for the environment, and no need for a corkscrew – are all highly attractive to younger people. Use glass for the wines that must have bottle aging.

Be Fun

This should be a given, but too many wineries want to seem serious and important. They work to create an intimidating environment that feels like an English gentleman’s club where the worldly matters of terroir and vintages are discussed at length. Tasting room bars become altars where “Guest Experience Ambassadors” with doctorates in winery ephemera give their sermons. There are some people that want to feel like they’re earning their somm pins when they visit a winery, but most people are visiting to have fun.

Nothing above has to do with specific marketing channels. The nature of a channel dictates the format and style of marketing but not necessarily the branded content you’re communicating. Your customers are on Instagram, TikTok, Facebook, Twitter, YouTube, etc., and your approach to those channels should be consistent in style and content with the marketing in your tasting room, printed materials, website, and email campaigns. What you communicate is more important than the where, though; chase your customers – not the latest tech trend. Be creatively, interestingly fun, focus on the simple mystique of wine, and build legitimacy with your customers.